2024 Tax Season Tips from the Desk of State Treasurer Fiona Ma

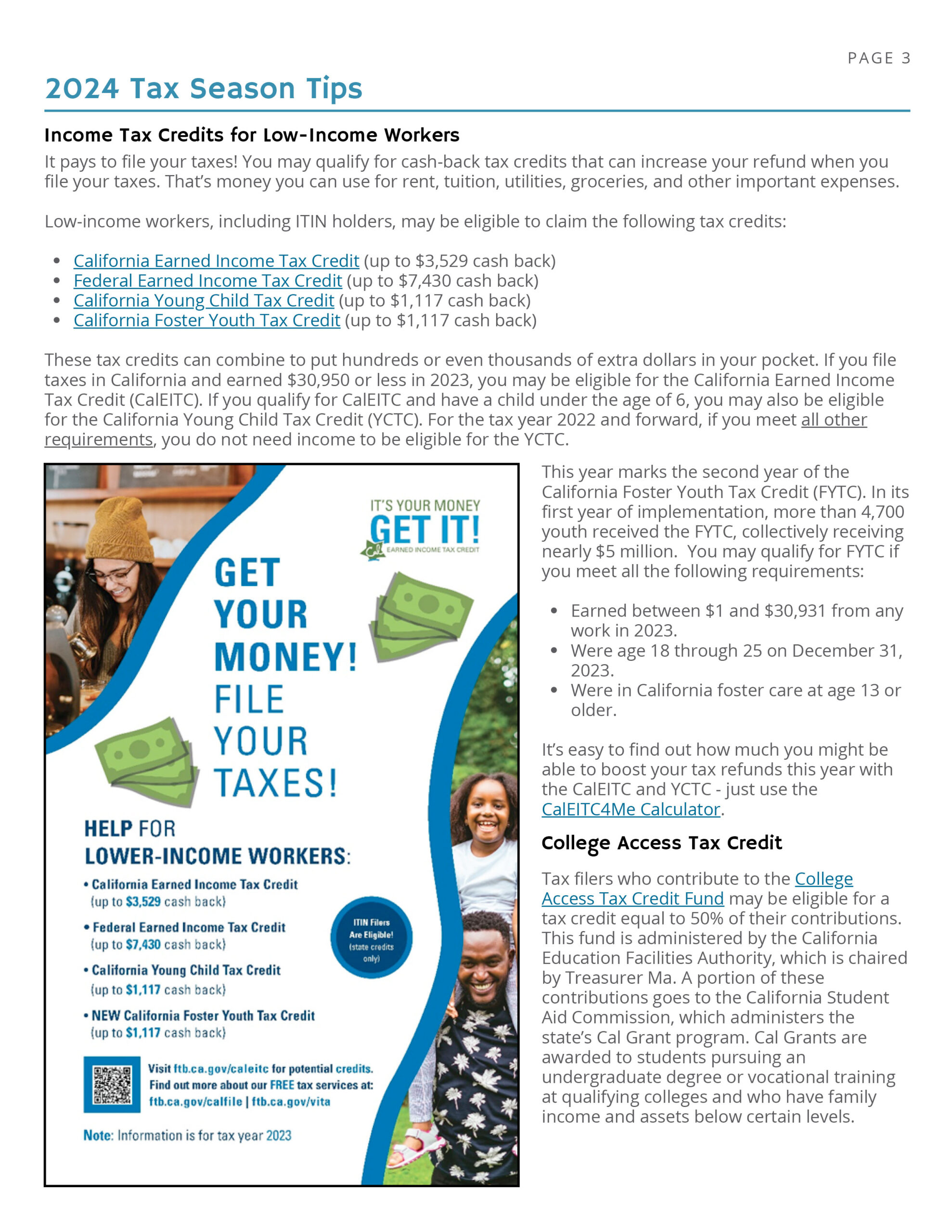

It pays to file your taxes! You may qualify for cash-back tax credits that can increase your refund when you file your taxes. That’s money you can use for rent, tuition, utilities, groceries, and other important expenses.

Low-income workers, including ITIN holders, may be eligible to claim the following tax credits:

California Earned Income Tax Credit (up to $3,529 cash back)

Federal Earned Income Tax Credit (up to $7,430 cash back)

California Young Child Tax Credit (up to $1,117 cash back)

California Foster Youth Tax Credit (up to $1,117 cash back)

These tax credits can combine to put hundreds or even thousands of extra dollars in your pocket. If you file taxes in California and earned $30,950 or less in 2023, you may be eligible for the California Earned Income Tax Credit (CalEITC). If you qualify for CalEITC and have a child under the age of 6, you may also be eligible for the California Young Child Tax Credit (YCTC). For the tax year 2022 and forward, if you meet all other requirements, you do not need income to be eligible for the YCTC.

This year marks the second year of the California Foster Youth Tax Credit (FYTC). In its first year of implementation, more than 4,700 youth received the FYTC, collectively receiving nearly $5 million.

You may qualify for FYTC if you meet all the following requirements:

Earned between $1 and $30,931 from any work in 2023.

Were age 18 through 25 on December 31, 2023.

Were in California foster care at age 13 or older.

It’s easy to find out how much you might be able to boost your tax refunds this year with the CalEITC and YCTC – just use the CalEITC4Me Calculator. Income Tax Credits for Low-Income Workers Tax filers who contribute to the College Access Tax Credit Fund may be eligible for a tax credit equal to 50% of their contributions.

This fund is administered by the California Education Facilities Authority, which is chaired by Treasurer Ma. A portion of these contributions goes to the California Student Aid Commission, which administers the state’s Cal Grant program. Cal Grants are awarded to students pursuing an undergraduate degree or vocational training at qualifying colleges and who have family income and assets below certain levels.

Please click here for a PDF Of information on the Tax Assistance available for Low Income Workers